When Will Oil Prices Increase Again

For more than a week now, oil prices have consolidated around the psychologically of import $40/barrel level as the worst of the recent oil toll crash appears to be in the rearview mirror. So far, OPEC+ product cuts appear to be going well with recalcitrant producers such equally Iraq, Kazakhstan, Republic of azerbaijan, Nigeria, and Republic of angola toeing the line and raising hopes that the markets have been effectively rebalanced. Nevertheless, some oil punters believe that this is just the beginning and that oil prices are set to soar into rarefied territory.

Specifically, JPMorgan has doubled-down on an earlier prediction of a "bullish supercycle" that could take oil prices well past $100/barrel due to a dramatic supply deficit.

Christyan Malek, JPMorgan's head of Europe, Middle Eastward and Africa oil and gas research, has reiterated an earlier bullish note where he had predicted that oil prices could soar to $190/barrel due to dramatic capex cuts past producers, amidst other factors.

Global oil hasn't seen $100-a-barrel prices since 2014, with $145/butt serving equally the high watermark for two decades.

Survival Mode

Source: Offshore Engineering

Malek has been bearish since 2013 but has now turned bullish due to what he sees as a looming 'very large supply-demand deficit' that could emerge in 2022 and possibly hit 6.viii million bpd by 2025 if the markets maintain their current trajectory.

Malek has not offered a price target for his bull example, but has told CNN Business organisation that his firm's $190 bullish call from March withal stands.

Malek says oil firms demand to spend heavily but to maintain production - something that is clearly not happening with global upstream investments expected to fall to a 15-year depression of $383 billion in the current year.

Interestingly, we had mirrored like concerns in a recent piece .

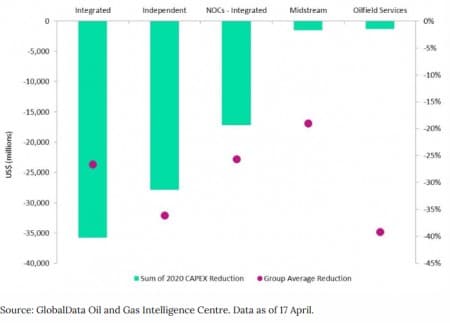

We had highlighted how the current level of capital spending is likely to negatively impact product - particularly if oil prices remain at these levels for a couple more years. With oil prices recently sinking to multi-yr lows and need severely suppressed by the Covid-19 crunch, U.S. shale producers have entered survival manner and cut 2022 capex by ~$85 billion in a bid to protect balance sheets, maintain shareholder pay-outs, and preserve liquidity. According to the Eia, oil supply would driblet by over 45 million bpd if no uppercase investment into existing or new fields was made between 2017-2025. Even connected investments into existing fields but with no new fields beingness brought online - aka the "observed reject" - would still pb to a decline of close to 27.5 one thousand thousand bpd over the forecast menses. Bold global oil demand falls by 10 million bpd in the mail-COVID-xix era , it would still leave a huge 17.v million bpd supply-need gap.

This suggests that production could exist materially affected if Capex remains at the current levels for another 2-3 years.

Nimble Shale

Whereas nosotros believe that production is likely to endure materially if capex levels don't ascent and thus support oil prices, we do not foresee a situation where oil prices could become well past $100/barrel every bit JPMorgan and Malek accept suggested.

Near two years ago, the Harvard Business Review predicted that we had seen the last of those huge oil boom-and-busts due to the rise of U.S. shale. According to HBR, smaller U.South. shale companies are much more nimble than traditional NOCs (national oil companies), leaving them well-placed to quickly answer to any temporary oil supply spikes or dips:

"... with oil producers in North America expanding output, prices are probable to remain volatile. Dissimilar national oil companies and oil majors that typically accept v to 10 years to develop conventional oil reserves, these contained and 'unconventional' players take improved their drilling and fracturing technology to the point where they tin respond within months to temporary spikes or dips in the market.

The recent cost swings highlight a new era of uncertainty gripping the world's free energy markets. As global oil producers work at cantankerous-purposes, the industry'due south traditional boom-bust cycle is being replaced past faster, shallower price rotations based on changes in production. It makes toll movements less extreme but also more difficult to predict. The constantly fluctuating number of barrels of crude bachelor from nimble shale operations is a primary driver, but so are the long-term impacts of increased fuel efficiency and the fits and starts of the global transition away from fossil fuels on world demand. The news is all good for customers, but it makes planning for the industry players much more difficult ."

The 1000000-dollar question is whether U.S. shale will be able to bounce back from the ongoing crunch with the same resilience information technology has displayed in the by.

After the 2015-16 oil bust, shale producers were able to outlive an earlier Saudi price war by lowering their costs by most 50 per centum and roping in investors, a move that triggered a spectacular new growth phase. As OPEC began cut production again, U.S. shale production jumped by nearly 4 million bpd in the infinite of about 3.5 years.

Unfortunately, it'due south quite a different ballgame this time effectually.

U.Southward. shale companies are already in survival style, having cutting capex by ~30 percent in the current year.

Capex was yet to return to earlier levels recorded before the last oil bust, significant they just don't have much leeway to make any more cuts without essentially hurting production. To brand matters worse, the sector is already heavily indebted and deeply out of favor. Executives may blame the Covid-19 pandemic and the Kingdom of saudi arabia/Russia price war for their ongoing distress, only the truth of the affair is that Wall Street and the investing universe had begun to sour on an industry that has for years prioritized growth over profitability.

Growth at the Correct Cost

Wall Street will likely remain unmoved until the oil cost rally reaches a critical level.

Both Saudi Arabia and Russian federation will exist keenly watching shale'due south struggles, hoping to capture a bigger slice of the market place. But this strategy is not without risks for either party - especially for Riyadh.

Both countries are highly reliant on oil revenues, with Moscow needing an oil price of ~$forty/barrel to balance its upkeep while Riyadh needs over $80/barrel to residuum its books as per the International monetary fund .

U.S. policymakers mostly blame Saudi arabia, non Trump, for the latest oil plummet.

Recently, oil-land senators threatened to withdraw military aid for Saudi arabia, and are likely to continue playing low-key hardball with the Kingdom as long every bit depression oil prices persist. Moscow, on its part, is already under U.Due south. free energy sanctions, and low oil prices will make Washington's restrictions even more painful.

Wall Street is unlikely to get interested in the nascent oil price rally, merely will probably throw its weight behind the sector once prices beginning approaching the $lxxx/barrel that Riyadh needs to balance its budget.

In other words, shale is likely to bounce back - just only at the right cost - at which point we could see a drench of the blackness commodity which will likely limit further advances in oil prices.

Lastly, the rapid rise of renewables is probable to cap the long-term gains by the oil sector considering information technology would make oil too uneconomical. Indeed, last yr, BNP Paribas told CNBC that oil prices demand to remain in the $10-20/butt to remain competitive in the pivotal mobility sector:

" What we're saying is if you're comparing investing money in renewable free energy in tandem with electric vehicles, you can become six to seven times the energy yield at the wheels – useful energy, mobility – for the same majuscule outlay as y'all tin spending on oil at the current market price of $lx a barrel, and so refining it into gasoline and using information technology in an internal combustion engine, which loses 80% of the energy every bit heat."

With EV penetration however depression, this is more than of a long-term business organization than a mid-term one. However, it's important to bear in mind that analysts accept repeatedly underestimated the growth of renewables over the past decade. Renewables are chop-chop replacing coal in the global energy mix and have connected to practise so during the Covid-19 crisis cheers to falling costs and the ESG megatrend.

It'due south probably safe for you to ignore those $190 oil price predictions.

By Alex Kimani for Oilprice.com

More than Elevation Reads From Oilprice.com:

- Oilfield Services May Non Recover Until 2023

- How Saudi Arabia Caused The Worst Oil Cost Crash In History

- Pirates Threaten Oil Operations In Gulf Of Mexico

Source: https://oilprice.com/Energy/Oil-Prices/Oil-May-Never-Hit-100-Again.html

Post a Comment for "When Will Oil Prices Increase Again"